Verizon announced its intention to acquire America Movil's US Tracfone property which includes not only the Tracfone brand but also nine other prepaid brands. The Tracfone property brings ~21M subscribers, 90K distribution doors and 850 employees.

The transaction will include $3.125 billion in cash and $3.125 billion in Verizon common stock and also includes up to an additional $650 million in future cash consideration related to the achievement of certain performance measures and other commercial arrangements. Expected deal close is 2H21.

Why It Matters

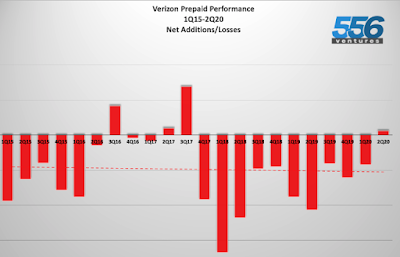

The old Verizon of old is gone in which it eschewed or minimized its prepaid operations for the chase of higher ARPU bearing postpaid users. Surprisingly after 10 quarters of net prepaid losses, 2Q20 showed a positive net adds.

As of 2Q20, prepaid only accounted for ~4M users (~4%) of the ~94M retail base. Tracfone by far has been the largest prepaid player and (if closed by 2H21), Verizon will be the largest prepaid player with ~25M subs. As of 2Q20, competitors' prepaid bases:

- AT&T (~18M)

- T-Mobile (~11+M)

- DISH (~9M)

Looking Ahead

Verizon could work the new acquisition in ARPU to drive greater revenue as Tracfone's ARPU has been steadily increasing to $28 partly due to the strength of Straight Talk. There is room to grow with peers' prepaid ARPU in the mid to high $30s. Going forward, it remains to be seen in 2H21 what Verizon will do with the multitude of value brands, whether to shrink and focus or leave under the notion that each value segment is important. My bet is consolidation as 10 brands on to of Verizon Prepaid, Visible and Yahoo Mobile is quite the stuffed portfolio.